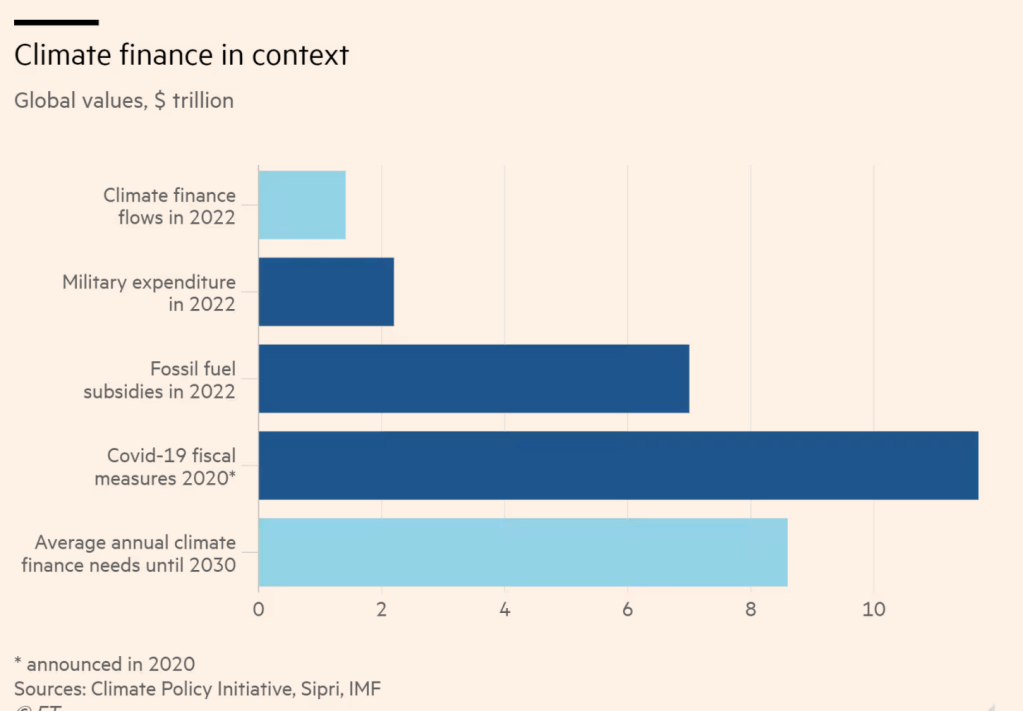

We are at the doorsteps of 2030, the year designated to reduce the global temperature increase to 1.5°C, and the picture is gloomy. Finance is a critical ingredient to saving our planet. And it seems to be in short supply. According to the IMF, the Asia-Pacific region faces a climate financing shortfall of at least $800 billion. The UN says that developing countries need at least ten times more money to adapt to the effects of climate change than they currently receive. The OECD estimates that developing countries will need around $2.4 trillion annually for climate investments between 2026 and 2030. A graphic (below) from a recent Financial Times article caught my attention. The climate finance flows in 2022 were a quarter of the annual climate finance needs till 2030. More money seems to have been spent on military and fossil fuel subsidies than on climate.

Is this likely to change? Unlikely. In 2024, 49% of the world’s voters will vote in elections across 64 countries. Most of the world is still struggling with economic woes, and many of the largest economies face budget deficits. Many industries are trying to come to terms with the economic reality. Thus, there is a shortage of both public and private funds.

Governments and private investors must urgently focus on climate finance and create innovative financing methods to attract capital. The Dubai Climate Summit has rightly drawn attention to blended finance (see https://www.linkedin.com/posts/umajmudar_blended-finance-activity-7073867065530470400-mKhd/), financing through a mix of public and private funds. Countries’ annual budgets must incorporate provisions for climate finance. Similarly, companies need to disclose their spending on climate/ESG.

The time for mere discussions on climate finance has passed. We are in a critical phase where action is the need of the hour. Let’s act now to secure a sustainable future for our planet!