Artificial Intelligence (AI), machine learning, and natural language processing have taken a firm foothold, and companies are exploring opportunities to leverage their power. AI and related tools will help investors navigate companies’ financial performance prospects and environmental, social and governance (ESG) factors.

Let’s look at some of the ways in which AI can support ESG investing:

Data standardization: AI can standardize and validate data from multiple sources, providing a more consistent and transparent view of ESG performance.

Data analytics: AI can collect and process large amounts of ESG data. This can help companies identify trends and track performance, resulting in improved investor decision-making.

ESG Ratings: AI can automate the analysis of diverse ESG datasets by creating standardised frameworks. This helps investors to compare and evaluate ESG performance consistently.

Portfolio construction: AI can help investors construct well-diversified portfolios. These portfolios not only align with sustainability goals but also seek to generate competitive financial returns.

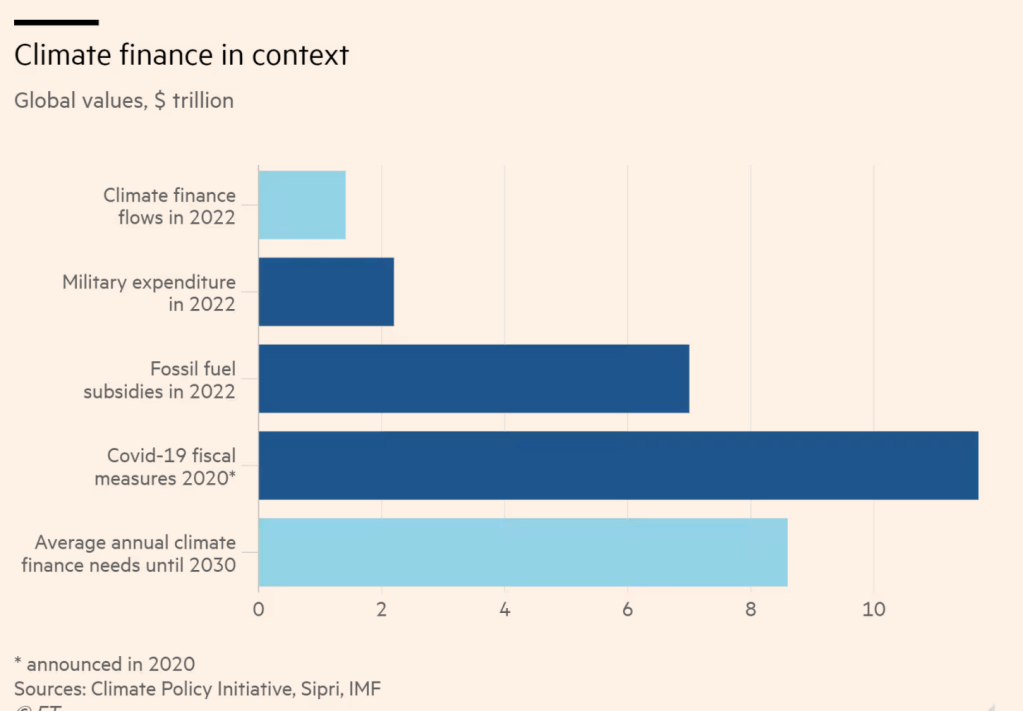

Risk assessment: AI can assess a company’s exposure to ESG risks, such as climate change, labour practices, and corporate governance.

Investment theses: AI can help firms create their own investment theses. They can use standardized and detailed taxonomies and materiality maps to refine their weighting of a large number of quantitative ESG sub-metrics.

While AI can bring tangible efficiencies in ESG investing there are several risks that need to be kept in mind. The quality of underlying data is always a concern. Garbage in Garbage out (GIGO) is a well-known technology risk. AI models are susceptible to biases in training data. Many of the ESG factors are complex and correlated. It needs an expert hand to make sure that they do not lead to misleading results. The use of AI raises ethical concerns, including privacy, data security, and the responsible use of technology.

While AI can enhance decision-making, it is important to strike the right balance between human judgment and AI-driven insights.