Awareness of climate change, global warming and environmental risks among people is increasing by the day. Many surveys have shown that people prefer greener or sustainable alternatives to current products. However, these preferences or intentions often do not translate into consumption, lifestyles, or travel patterns.

On the flip side, companies also do the same. According to a study published by Deloitte recently, 63% of C-suite executives worldwide recognise the need for businesses to take climate action. However, only a fifth of the companies are actually taking decisive steps on sustainability.

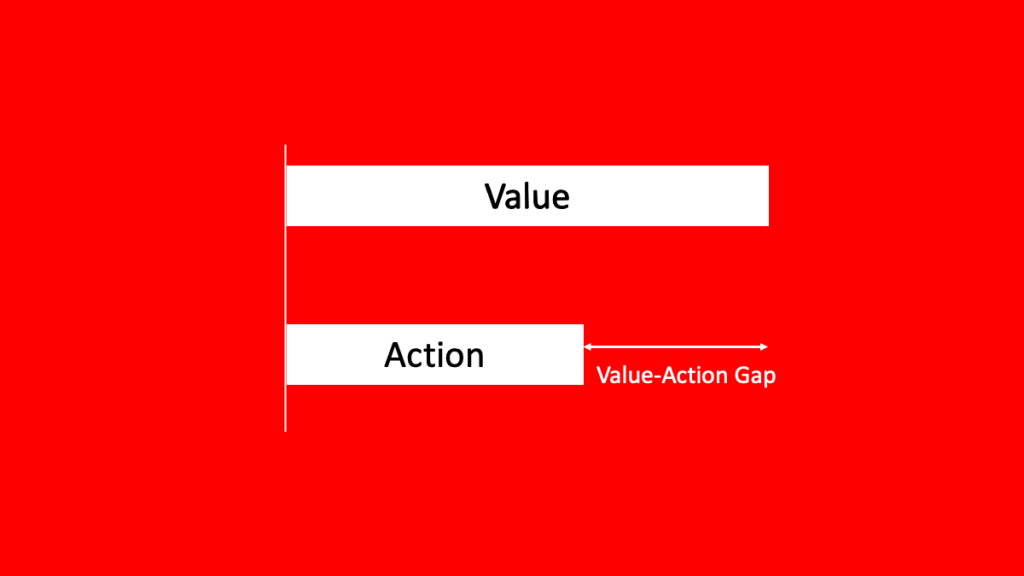

This discrepancy between stated beliefs and behaviours is known as Value-Action Gap. First, let us examine how stated beliefs come about. There are three possible causes:

- The value system — a genuine desire to do something for the environment.

- Peer pressure makes you look good in front of your friends and colleagues.

- The role of the influencers – prominent people or role models who espouse sustainable causes.

So, what leads to the value-action gap

1. Information deficit: There is often an information deficit facing the customers. Which brands and products are truly “sustainable?” Which certifications are important? Which materials are superior?

From a company’s perspective finding the right technology for emission reduction would be an information issue.

2. Costs: There is a search cost associated with finding sustainable products. Psychological costs (stressing about the purchase) and monetary costs (going to the right store) impact decision making.

Companies, when faced with ESG challenges, face similar costs.

Reducing the value-action gap requires a reduction of these costs.

The move to sustainability cannot be achieved without attention to the value-action gap. Three actions can help reduce the gap: increasing the customer’s/company’s capability or the company, motivating them towards intended behaviours, and providing opportunities to improve behaviours. Policymakers need to account for this while creating policies aimed at creating a sustainable or circular economy.